1

Please refer to important disclosures at the end of this report

1

1

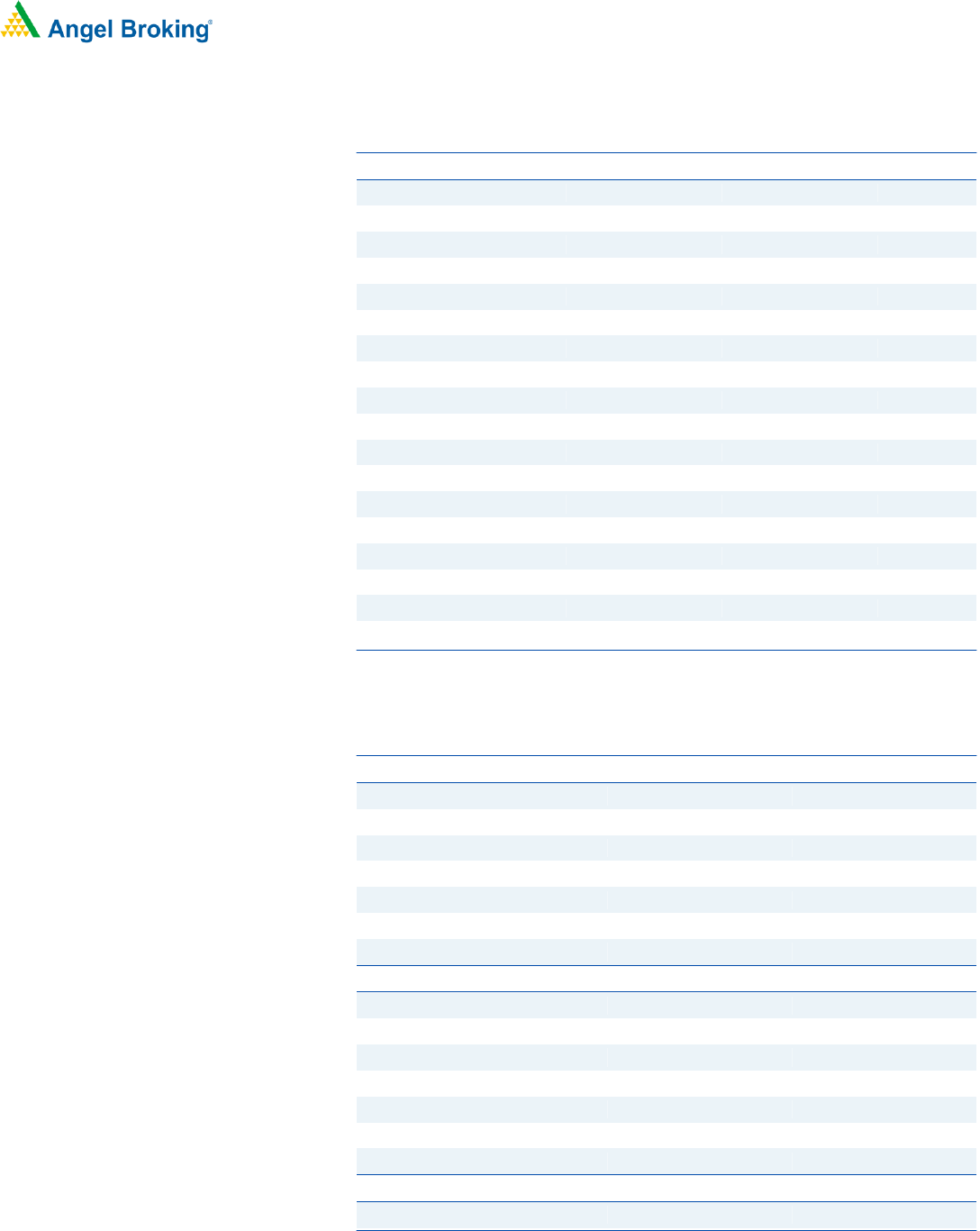

Particulars (` cr)

Q3FY20

Q2FY20

% chg (qoq)

Q3FY19

% chg (yoy)

NII

14,173

13,515

4.9

12,577

12.7

Pre-prov. profit

12,945

11,698

10.7

10,779

20.1

PAT

7,416

6,345

16.9

5,586

32.8

Source: Company

For 3QFY2020, HDFC Bank's PAT surged 33% yoy led by 20% yoy increase in pre-

provision profit and higher other income coupled with tax benefits, which supported

profitability. Loan book continued to grow at 20% yoy supported by wholesale book,

however, NII growth was subdued at 13% (higher balance sheet liquidity). On asset

quality front, headline asset quality remained stable however; slippages and credit

costs remained elevated. Deposits grew at 25% yoy (4.5% qoq) owing to 28.6% yoy

growth in term CA deposit. CASA mix improved 24bps qoq to 39.5% (40.7% in

3QFY2019).

Loan growth strong led by pick up in corporate loan book: Softening of auto loan

segment (contributes 25% of retail loans), which grew 2.3% yoy led to moderate

growth in advances. Credit card and personal loans reported healthy growth of

28.6% yoy and 23.3% yoy, respectively. Wholesale loans grew by 26.6%, while retail

loans moderated to 14.1% yoy. Despite heavy advertisement during festive season,

retail growth remained moderate.

Non-interest income grew strong, cost/income declined: Total other income grew at a

healthy rate of 35.5% yoy led by healthy core fee income. Core fee income grew by

24.1% yoy owing to sustained growth in payment-related fees (~35% of total) and

improvement in fees from third-party products (improvement in yield). The

management said that retail accounts for ~93% of fee income, while treasury gains

and one-off recovery from the resolution of a NCLT matter also supported other

income. From last four quarters, the bank's C/I is consistently in a declining trend,

and for Q3FY2020, CI declined 50bps/87bps on yoy/qoq basis to 37.9% on the

back of 18% yoy growth in operating expenses and revenue growth of 19% yoy.

Management has guided for 300bps decline in C/I over the next 3-5 years.

Asset quality disappoints; slippages, credit costs higher: In absolute terms, GNPA

went up by `919cr, up 7.3% qoq and stood at 1.42%, NPA increased by `677cr, up

17% qoq. The provision coverage ratio for the quarter declined ~300bps to 67%

even after taking ~37% growth in provisions. Gross slippages remained high at

`5,300cr (2.4% annual slippages), this was largely driven by slippages in agriculture

portfolio and one-off corporate slippages. However, core slippages were at 1.7%.

Management gave positive commentary on retail asset quality while sounded a bit

concerned about CV/CE portfolio owing to the weak underlying macro environment.

The credit cost ratio remained high at 1.3%.

Outlook & Valuation: Credit growth beat the industry growth rate driven by strong

retail business. The strong liability franchise and healthy capitalisation provides

earnings visibility. We value HDFC Bank using SOTP method, valuing standalone

banking business at 3.7x of FY2021 ABV and its two subsidiaries at `78/share. We

recommend a Hold on the stock, with a target price of `1,390/ share.

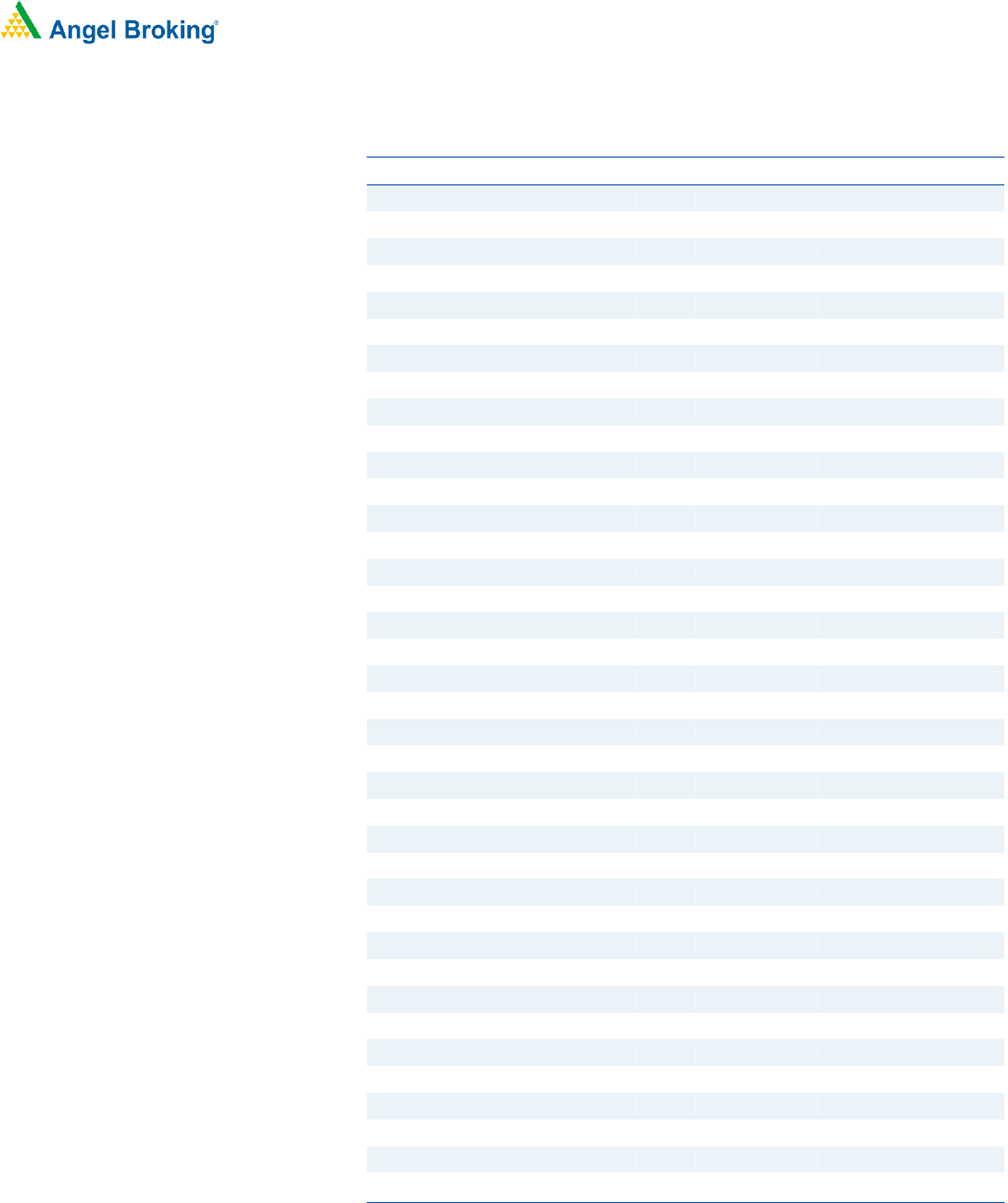

Key Performance

Y/E March (` cr)

FY18

FY19

FY20E

FY21E

FY22E

NII

40,092

48,243

55,893

66,462

79,499

% chg

21.0

20.3

15.9

18.9

19.6

Net profit

17,486

21,078

26,291

31,456

38,101

% chg

20.2

20.5

24.7

19.6

21.1

NIM (%)

4.4

4.4

4.3

4.3

4.3

EPS ( `)

33.8

38.7

48.0

57.4

69.6

P/E (x)

37.3

32.6

26.2

21.9

18.1

P/ABV (x)

6.2

4.8

4.1

3.5

3.1

RoA (%)

1.8

1.8

1.9

1.9

2.0

RoE (%)

18.2

16.8

16.7

17.2

18.0

Source: Company, Angel Research; Note: CMP as of Jan 20, 2019

HOLD

CMP `1,255

Target Price `1,390

Investment Period 12 Months

Stock Info

Sector

Bloomberg Code

Shareholding Pattern (%)

Promoters 21.3

MF / Banks / Indian Fls 17.1

FII / NRIs / OCBs 30.8

Indian Public / Others 12.0

Abs. (%) 3m 1yr 3yr

Sensex 6.6 13.5 53.6

HDFC Bank 1.3 16.9 102.9

Beta

1.1

Banking

Market Cap (` cr)

6,87,312

52 Week High / Low

1306/1011

Avg. Daily Volume

7,32,922

Face Value (`)

1

BSE Sensex

41,529

Nifty

12,225

Reuters Code

HDBK.BO

HDFCB IN

3-Year Price Chart

Source: Company

400

600

800

1000

1200

1400

Oct-16

Jan-17

Apr-17

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Oct-18

Jan-19

Apr-19

Jul-19

Oct-19

HDFC Bank

Other income aids top-line; credit costs, slippages elevated

Q3FY2020 Result Update | Banking

Jan 21, 2020

2

HDFC Bank| Q3FY2020 Result Update

Jan 21, 20

2

Exhibit 1: Quarterly Performance

Particulars (` cr)

Q2FY19

Q3FY19

Q4FY19

Q1FY20

Q2FY20

Q3FY20

% YoY

% QoQ

Interest earned

24,200

25,890

26,333

27,392

28,166

29,370

13.4

4.3

- on Advances / Bills

18,828

20,306

21,019

21,805

22,514

23,425

15.4

4.0

- on investments

5,042

5,319

5,047

5,248

5,092

5,203

(2.2)

2.2

- on balance with RBI & others

94

98

112

175

416

608

519.2

46.1

- on others

236

167

155

164

144

134

(19.8)

(7.3)

Interest Expended

12,436

13,314

13,244

14,097

14,651

15,197

14.1

3.7

Net Interest Income

11,763

12,577

13,089

13,294

13,515

14,173

12.7

4.9

Other income

4,016

4,921

4,871

4,970

5,589

6,669

35.5

19.3

- Fee & commission income

3,296

3,647

3,692

3,552

4,055

4,527

24.1

11.6

- Treasury income

(33)

474

229

212

481

677

42.7

40.7

- Forex & derivative income

420

398

403

577

552

526

32.2

(4.7)

Others

333

403

547

630

502

940

133.6

87.3

C/I%

39.9

38.4

39.6

39.0

38.8

37.9

(51.3)bp

(87.7)bp

Operating income

15,779

17,498

17,961

18,264

19,104

20,842

19.1

9.1

Operating expenses

6,299

6,719

7,117

7,117

7,406

7,897

17.5

6.6

- Employee expenses

1,909

1,968

2,074

2,217

2,355

2,455

24.8

4.2

- Other Opex

4,390

4,752

5,043

4,900

5,051

5,442

14.5

7.7

Pre-provision Profit

9,480

10,779

10,844

11,147

11,698

12,945

20.1

10.7

Provisions & Contingencies

1,820

2,212

1,889

2,614

2,701

3,044

37.6

12.7

PBT

7,660

8,567

8,954

8,533

8,998

9,902

15.6

10.1

Provision for Tax

2,654

2,981

3,069

2,965

2,652

2,485

(16.6)

(6.3)

PAT

5,006

5,586

5,885

5,568

6,345

7,416

32.8

16.9

Effective Tax Rate (%)

35

35

34

35

29

25

(969.7)bp

(437.9)bp

Liability Profile

Advance

7,50,838

7,80,951

8,19,401

8,29,730

8,96,984

9,36,030

19.9

4.4

Deposit

8,33,364

8,52,502

9,23,141

9,54,554

10,21,615

10,67,433

25.2

4.5

Term deposit

5,05,418

5,31,943

5,31,943

5,75,553

6,20,379

6,45,606

21.4

4.1

CA

1,15,131

1,11,905

1,42,498

1,25,663

1,36,791

1,43,900

28.6

5.2

SA

2,34,568

2,35,179

2,48,700

2,53,338

2,64,445

2,77,928

18.2

5.1

CASA

3,49,699

3,47,084

3,91,198

3,79,001

4,01,236

4,21,828

21.5

5.1

CASA%

42.0

40.7

42.4

39.7

39.3

39.5

(119.6)bp

24.3bp

CA%

13.8

13.1

15.4

13.2

13.4

13.5

35.4bp

9.1bp

SA%

28.1

27.6

26.9

26.5

25.9

26.0

(155)bp

15.2bp

C/D

90.1

91.6

88.8

86.9

87.8

87.7

(391.7)bp

(11.1)bp

NIM (Reported)%

4.3

4.3

4.4

4.3

4.2

4.2

(10)bp

0bp

Source: Company, Angel Research

3

HDFC Bank| Q3FY2020 Result Update

Jan 21, 20

3

Exhibit 2: Profitability

Profitability Ratios

Q2FY19

Q3FY19

Q4FY19

Q1FY20

Q2FY20

Q3FY20

% YoY

% QoQ

Advance Yield

10.32

10.61

10.51

10.58

10.43

10.22

(38.2)bp

(20.7)bp

Investment Yield

7.0

7.3

7.1

7.1

6.7

6.7

(60.8)bp

0.5bp

NIM

4.37

4.51

4.54

4.42

4.34

4.32

(19.1)bp

(2.7)bp

COF

5.23

5.46

5.25

5.38

5.40

5.30

(15.8)bp

(10.5)bp

Spread

5.1

5.1

5.3

5.2

5.0

4.9

(22.4)bp

(10.3)bp

RoA

1.8

1.9

1.95

1.79

2.03

2.29

38bp

26.4bp

RoE

16.4

15.9

16.1

14.6

16.3

18.6

263bp

227.8bp

Exhibit 3: Advance trend

Particulars (` cr)

Q2FY19

Q3FY19

Q4FY19

Q1FY20

Q2FY20

Q3FY20

% YoY

% QoQ

Auto

91,920

93,023

91,383

92,086

90,748

92,205

(0.9)

1.6

Two Wheelers

11,290

11,369

11,271

11,334

11,232

11,255

(1.0)

0.2

CV/CE

49,548

52,880

55,429

55,200

54,272

54,771

3.6

0.9

Sub-total - Auto Loans

1,52,758

1,57,272

1,58,083

1,58,620

1,56,252

1,58,231

0.6

1.3

Personal Loans

84,145

89,550

93,806

97,986

1,02,861

1,10,174

23.0

7.1

Home Loans

47,875

51,799

51,372

55,781

60,029

61,741

19.2

2.9

Business Banking

1,17,039

1,20,429

1,25,014

1,26,099

1,36,578

1,42,599

18.4

4.4

Kisan Gold Card

37,068

36,349

40,362

38,556

40,929

40,916

12.6

(0.0)

Credit Cards

40,535

44,839

46,630

49,523

52,043

57,678

28.6

10.8

Others

21,023

22,403

22,771

22,310

22,824

26,812

19.7

17.5

Gold Loans

5,701

5,760

5,838

5,924

6,086

6,119

6.2

0.5

Loans against securities

3,580

3,455

3,598

3,350

3,252

3,208

(7.1)

(1.4)

Total Retail Advances

5,09,724

5,31,856

5,47,474

5,58,149

5,80,854

6,07,478

14.2

4.6

Corporate & International

2,41,114

2,49,095

2,71,927

2,71,581

3,16,130

3,28,552

31.9

3.9

Total loans

7,50,838

7,80,951

8,19,401

8,29,730

8,96,984

9,36,030

19.9

4.4

Retail

68

68

67

67

65

65

(320.4)bp

14.3bp

Corporate

32

32

33

33

35

35

320.4bp

(14.3)bp

Company, Angel Research

Exhibit 4: GNPA/NPA stable, Bank took contingent provision worth of `700Cr

Particular

Q2FY19

Q3FY19

Q4FY19

Q1FY20

Q2FY20

Q3FY20

% YoY

% QoQ

GNPA

10,098

10,903

11,224

11,769

12,508

13,427

23.2

7.3

GNPA

3,028

3,302

3,215

3,567

3,791

4,468

35.3

17.9

GNPA%

1.33

1.38

1.36

1.40

1.38

1.42

4bp

4bp

NPA%

0.40

0.42

0.39

0.43

0.42

0.48

6bp

6bp

Slippage (%) Annl

2.3

2.0

1.75

2.04

1.66

1.64

(40.8)bp

(1.6)bp

Slippages

4,333

4,000

3,580

4,225

3,714

3,839

(4.0)

3.4

Credit Cost (%)

0.97

1.13

0.92

1.26

1.20

1.30

16.8bp

9.6bp

Provision Calc

69.92

69.57

71.32

69.29

69.57

66.20

(336.8)bp

(336.8)bp

Company, Angel Research

4

HDFC Bank| Q3FY2020 Result Update

Jan 21, 20

4

Outlook & Valuation: Credit growth beat the industry growth rate driven by strong

retail business. The strong liability franchise and healthy capitalisation provides

earnings visibility. We value HDFC Bank using SOTP method, valuing standalone

banking business at 3.7x of FY2021 ABV and its two subsidiaries at `78/share. We

recommend a Hold on the stock, with a target price of `1,390/ share.

Exhibit 5: Valuation Summary

Particulars

%

Valuation

Methodology

Value/share

(`)

Value of HDFC Bank standalone

100

3.7x FY21E ABV

1316

Subsidiaries

HDB Fin

96%

3.5x FY21E ABV

65

HDFC Sec

98%

15x of FY21 PAT

11

Less: Cost of investments

(7)

Fair value per share

1390

Source: Company, Angel Research

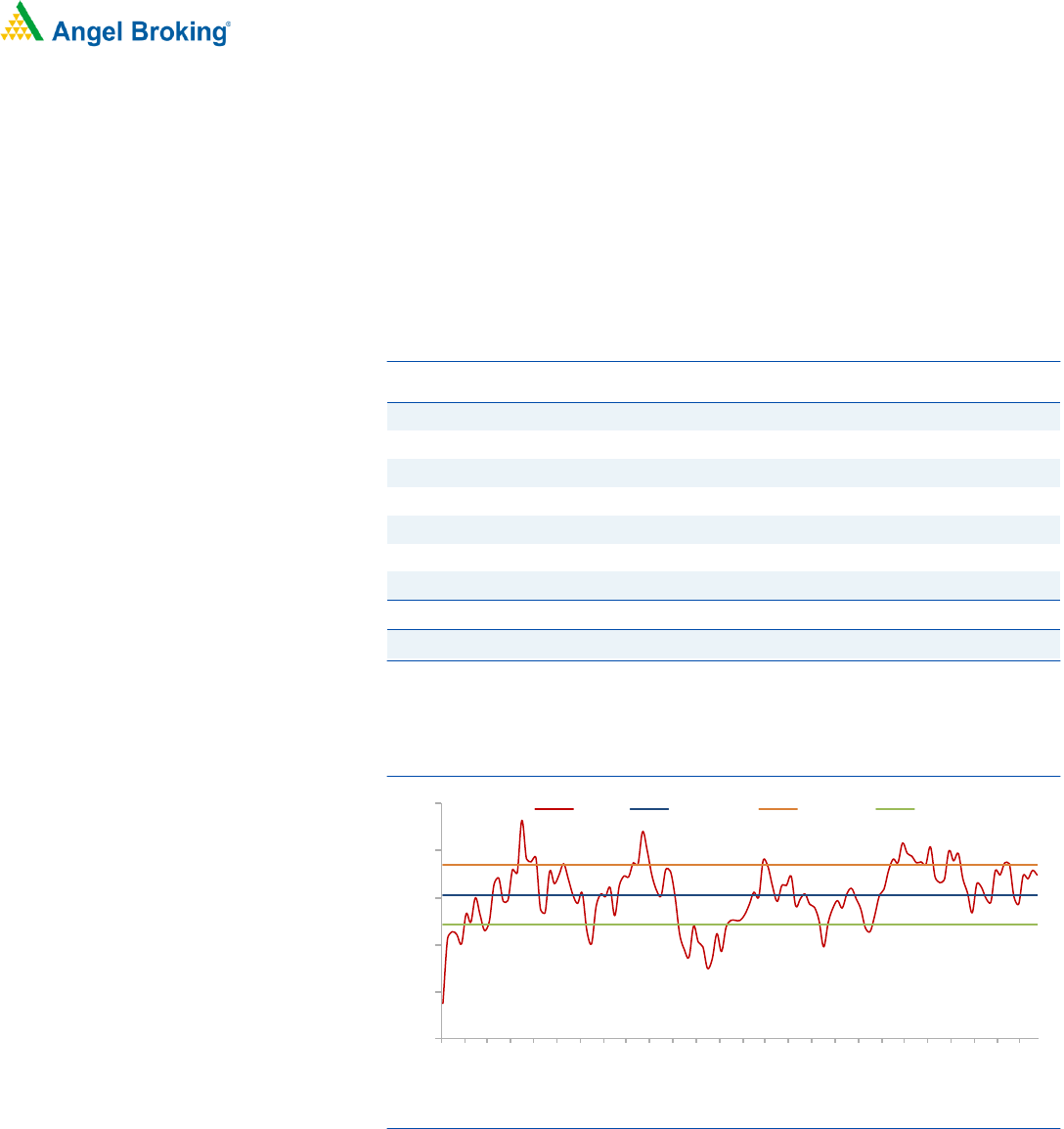

Exhibit 6: One year forward P/BV (x)

Source: Company, Angel Research

3.74

3.53

3.85

3.21

2

2.5

3

3.5

4

4.5

Apr-09

Sep-09

Feb-10

Jul-10

Dec-10

May-11

Oct-11

Mar-12

Aug-12

Jan-13

Jun-13

Nov-13

Apr-14

Sep-14

Feb-15

Jul-15

Dec-15

May-16

Oct-16

Mar-17

Aug-17

Jan-18

Jun-18

Nov-18

Apr-19

Sep-19

P/BV

Avg. P/BV

+1STD

-1STD

5

HDFC Bank| Q3FY2020 Result Update

Jan 21, 20

5

Income Statement (Standalone)

Y/E March (` cr)

FY18

FY19E

FY20E

FY21E

FY22E

Net Interest Income

40,092

48,243

55,893

66,462

79,499

- YoY Growth (%)

21.0

20.3

15.9

18.9

19.6

Other Income

15,221

17,626

23,203

25,870

30,771

- YoY Growth (%)

23.8

15.8

31.6

11.5

18.9

Operating Income

55,313

65,869

79,096

92,333

1,10,270

- YoY Growth (%)

21.7

19.1

20.1

16.7

19.4

Operating Expenses

22,690

26,119

30,806

36,513

43,339

- YoY Growth (%)

15.2

15.1

17.9

18.5

18.7

Pre - Provision Profit

32,623

39,750

48,290

55,819

66,930

- YoY Growth (%)

26.8

21.8

21.5

15.6

19.9

Prov. & Cont.

5,927

7,550

11,554

13,782

16,013

- YoY Growth (%)

65.0

27.4

53.0

19.3

16.2

Profit Before Tax

26,696

32,200

36,736

42,037

50,917

- YoY Growth (%)

20.6

20.6

14.1

14.4

21.1

Prov. for Taxation

9,210

11,122

10,445

10,581

12,816

- as a % of PBT

34.5

34.5

28.4

25.2

25.2

PAT

17,486

21,078

26,291

31,456

38,101

- YoY Growth (%)

20.2

20.5

24.7

19.6

21.1

Balance sheet (Standalone)

Y/E March (` cr)

FY18

FY19E

FY20E

FY21E

FY22E

Share Capital

518

545

548

548

548

Reserves & Surplus

1,05,776

1,43,882

1,70,005

1,95,374

2,26,106

Net Worth

1,06,294

1,44,427

1,70,553

1,95,921

2,26,653

Deposits

7,88,770

9,23,141

11,26,232

13,51,478

16,21,774

- Growth (%)

22.5

17.0

22.0

20.0

20.0

Borrowings

1,23,105

1,17,085

1,01,361

1,35,148

1,62,177

Other Liab & Prov.

45,764

55,108

67,574

81,089

97,306

Total Liabilities

10,63,933

12,39,761

14,65,719

17,63,636

21,07,911

Cash balances

1,04,670

46,764

90,099

94,603

97,306

Bank balances

18,244

34,584

11,262

21,624

25,948

Investments

2,42,200

2,90,588

3,37,870

4,05,443

4,86,532

Advances

6,58,333

8,19,401

9,83,281

11,79,938

14,15,925

- Growth (%)

18.7

24.5

20.0

20.0

20.0

Fixed Assets

3,607

4,030

4,525

8,379

10,055

Other Assets

36,879

44,395

38,683

53,649

72,144

Total Assets

10,63,933

12,39,761

14,65,719

17,63,636

21,07,911

- Growth (%)

23.6

16.5

18.2

20.3

19.5

6

HDFC Bank| Q3FY2020 Result Update

Jan 21, 20

6

Ratio analysis (Standalone)

Y/E March

FY17

FY18

FY19E

FY20E

FY21E

FY22E

Profitability Ratios (%)

NIMs

4.46

4.35

4.36

4.28

4.25

4.27

Cost to Income Ratio

43.4

41.0

39.7

38.9

39.5

39.3

RoA

1.9

1.8

1.8

1.9

1.9

2.0

RoE

18.3

18.2

16.8

16.7

17.2

18.0

B/S ratios (%)

CASA Ratio

48.0

43.5

42.4

45.0

45.0

45.0

Credit/Deposit Ratio

86.2

83.5

88.8

87.3

87.3

87.3

Asset Quality (%)

Gross NPAs

1.1

1.3

1.3

1.4

1.4

1.4

Net NPAs

0.3

0.4

0.4

0.5

0.5

0.4

Slippages

1.5

1.5

2.2

2.0

2.0

2.0

Loan Loss Prov./Avg. Assets

0.6

0.9

0.9

1.2

1.2

1.1

Provision Coverage

69

69

69

66

67

71

Per Share Data (`)

EPS

28.4

33.8

38.7

48.0

57.4

69.6

BVPS

168

205

265

311

358

414

ABVPS

167

204

263

310

356

410

DPS

5.5

6.5

7.5

8.5

9.5

11.5

Valuation Ratios

PER (x)

44.4

37.3

32.6

26.2

21.9

18.1

P/BVPS (x)

7.49

6.14

4.75

4.05

3.52

3.04

P/ABVPS (x)

7.54

6.19

4.78

4.07

3.54

3.08

Dividend Yield

0.4

0.5

0.6

0.7

0.8

0.9

DuPont Analysis (%)

FY17

FY18

FY19E

FY20E

FY21E

FY22E

Interest Income

8.83

8.34

8.59

8.55

8.51

8.57

Interest Expenses

4.61

4.17

4.40

4.42

4.39

4.46

NII

4.22

4.17

4.19

4.13

4.12

4.11

Non Interest Income

1.57

1.58

1.53

1.72

1.60

1.59

Total Revenues

5.79

5.75

5.72

5.85

5.72

5.70

Operating Cost

2.51

2.36

2.27

2.28

2.26

2.24

PPP

3.28

3.39

3.45

3.57

3.46

3.46

Total Provisions

0.46

0.62

0.66

0.85

0.85

0.83

PreTax Profit

2.82

2.77

2.80

2.72

2.60

2.63

Tax

0.97

0.96

0.97

0.77

0.66

0.66

ROA

1.85

1.82

1.83

1.94

1.95

1.97

Leverage

9.88

10.00

9.19

8.59

8.81

9.16

RoE (%)

18.32

18.17

16.81

16.69

17.17

18.03

Valuation done on closing price of 21/01/2020

7

HDFC Bank| Q3FY2020 Result Update

Jan 21, 20

7

Disclosure of Interest Statement HDFC Bank

1. Financial interest of research analyst or Angel or his Associate or his relative No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3. Served as an officer, director or employee of the company covered under Research No

4. Broking relationship with company covered under Research No

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)

Note: We have not considered any Exposure below

`

1 lakh for Angel, its Group companies and Directors